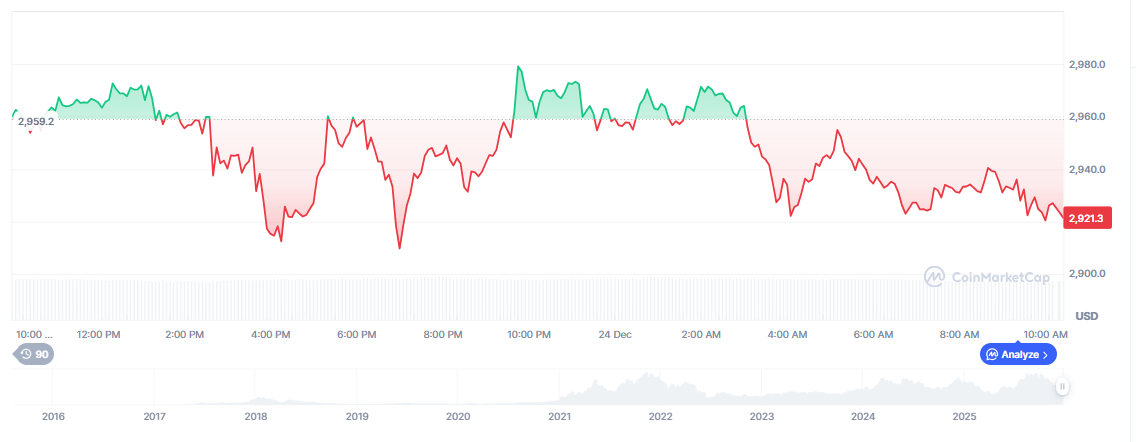

Ethereum price prediction is in sharp focus as ETH trades at $2,926.60, down 1.13% over the past 24 hours. While the coin holds above key support levels, market sentiment remains bearish with the Fear & Greed Index at just 24.

Traders are watching closely as ETH hovers near psychological levels, and many are now turning attention to early-stage alternatives like Bitcoin Hyper, a presale token nearing a key funding milestone.

ETH Struggles to Hold Momentum Amid Fear-Driven Markets

Ethereum is currently trading at $2,923.97, with a market cap of $352.91 billion and 24-hour trading volume of $33.63 billion. Volatility sits at 3.90%, considered medium.

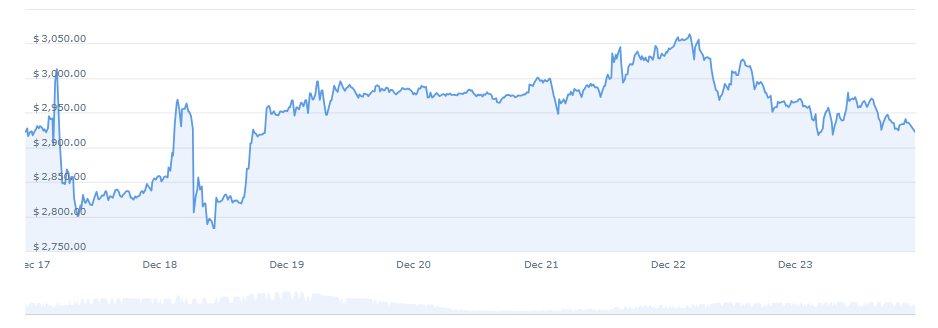

In the last 24 hours, ETH ranged between $2,911.68 and $2,979.57, with a daily drop of 1.14%. This puts Ethereum in a tight sideways zone, and sentiment metrics indicate growing indecision.

The price remains above the cycle low of $2,631.93, offering some near-term reassurance for holders. However, without a strong catalyst, the sideways structure could break down if volume declines further.

Technical Structure Remains Fragile but Not Broken

The technical sentiment for Ethereum is currently rated bearish. The $2,900 level continues to act as a fragile support zone, and any decisive break below it could trigger further downside toward $2,830 or even the $2,631 low.

On the upside, resistance is forming around $2,980 and $3,050. Despite the current bearish momentum, the broader market hasn’t seen a significant rise in selling volume, which means the dip may reflect macro-level caution rather than a breakdown in fundamentals.

The 12.05% market dominance of ETH has held steady, reinforcing its role as the top altcoin in the ecosystem. Still, short-term investors are reacting to fear, not fundamentals.

One-Year and Monthly Performance Highlight Stability With Long-Term Upside

Compared to this time last year, Ethereum is down 14.07%, falling from $3,405.84 on December 24, 2024. However, on a 1-month basis, ETH has risen from $2,833.00, marking a 3.31% gain.

This contrast shows a pattern of slow accumulation after a broader correction, and may hint at an early accumulation phase going into 2026. The coin has managed to hold relatively flat week-over-week, with a 0.08% increase, confirming the narrow consolidation structure traders are now watching closely.

| Date | Price | % Change |

| December 24, 2025 | $2,926.66 | -1.15% (24h) |

| December 17, 2025 | $2,924.38 | +0.08% (7d) |

| November 24, 2025 | $2,833.00 | +3.31% (30d) |

| December 24, 2024 | $3,405.84 | -14.07% (1yr) |

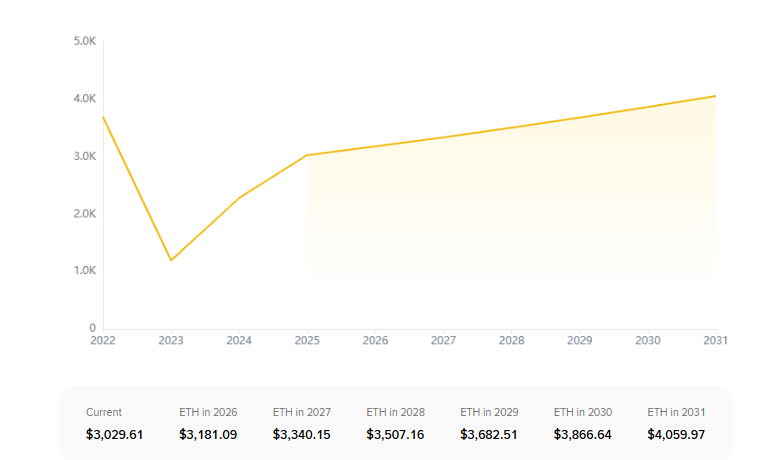

Despite short-term bearishness, long-term forecasts for Ethereum price prediction remain optimistic. The current projected trajectory puts ETH at $3,181.09 in 2026, gradually increasing to $4,059.97 by 2031.

These predictions factor in low supply inflation (0.20%), continued staking growth, and sustained Layer 2 development.

Ethereum’s supply remains stable, with 120.69 million ETH in circulation and no hard cap. While projections show steady growth, they also depend on broader market recovery and improved risk appetite across institutional and retail segments.

Rotation Into Presales Grows as Bitcoin Hyper Approaches Price Jump

With Ethereum consolidating and volatility staying muted, many retail traders are shifting focus toward early-stage tokens like Bitcoin Hyper. Currently priced at $0.013475, Bitcoin Hyper has already raised $29.73 million out of a $30.14 million target.

Only one day remains until the next automatic price increase, which has fueled increased investor attention. While Ethereum remains a strong long-term asset, smaller cap tokens with momentum narratives are becoming increasingly attractive to short-term risk-tolerant buyers.

The Ethereum price prediction still supports a recovery scenario, but timing remains uncertain, and alternative presale assets are gaining traction in the meantime.