Exodus Movement EXOD and CleanSpark CLSK are two prominent players in the cryptocurrency market serving different purposes. While Exodus Movement is growing fast as a self-custodial wallet and Web3 financial services solution provider with more than $3 trillion market cap of cryptocurrency, CleanSpark, being a Bitcoin miner, holds over 13,000 Bitcoin valued at approximately $1.2 billion in treasury.

Given their evolving strategies, the question remains: which crypto stock has more upside potential? Let us break down their fundamentals, growth prospects, market challenges, and valuation to determine which offers a more compelling investment case.

The Case for Exodus Movement Stock

Besides the fact that EXOD holds more than $3 trillion market cap of cryptocurrency, the company has entered into the stablecoin market and now commands $26 trillion in stablecoin transaction volume. Exodus Movement revenues climbed 51% year over year on the back of rising digital asset prices throughout 2025.

Exodus Movement’s entrance into the high-growth Stablecoin payments market, with the Grateful acquisition, is another tailwind. Exodus Movement can now provide instant merchant settlement, charge lower fees per transaction and is set to enter into the Argentinian and Uruguayan markets.

EXOD also saw 82% year-over-year growth in swap volume in the third quarter of 2025, of which 28% of the volume was contributed by B2B swaps. Contribution from rising trading activity, user engagement and strong partner base has been a major tailwind for EXOD. Exodus Movement added 16 new partners in the third quarter of 2025, of which 10 are already paying.

To top it off, EXOD now has a pool of $315 million worth of digital and liquid assets, which makes its balance sheet robust as it has no debt. Analysts are optimistic about EXOD’s bottom-line growth as well. The Zacks Consensus Estimate for Exodus Movement’s 2025 earnings has been revised upward in the past 60 days.

Image Source: Zacks Investment Research

The Case for CleanSpark Stock

Although CleanSpark has been one of the major bitcoin mining companies, it is transitioning toward a diversified digital infrastructure model. The company’s management is now looking at the opportunities created by the fast-growing AI and high-performance computing (HPC) market that CLSK can capture by rapidly upscaling its existing infrastructure.

This transformation is expected to broaden CLSK’s revenue base, improve profitability and unlock sustainable shareholder returns. CleanSpark will leverage its large 1.3 gigawatts of electricity and land portfolio across the United States to execute this shift. The company is also partnering with Submer to further support this transition.

CLSK has acquired a 285 MW site in Texas to build an AI campus and has identified a 250 MW site in Georgia that is suitable for AI development. CleanSpark’s fiscal 2025 roadmap shows a structured expansion plan through 2026-2028, covering portfolio scaling, large-scale commissioning, tenant diversification and multi-campus development.

However, CLSK faces intense competition from hyperscalers and other crypto mining companies like IREN Limited, Marathon Digital and Cipher Mining Inc., which are also transitioning toward AI and HPC. Given this transitional expense, the company’s bottom line remains constrained. The Zacks Consensus Estimate for CLSK’s fiscal 2026 earnings has been revised downward in the past 30 days.

Image Source: Zacks Investment Research

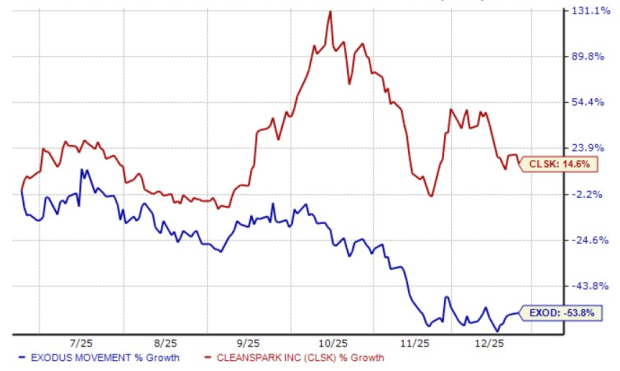

EXOD vs. CLSK: Price Performance and Valuation

In the past six months, EXOD shares have lost 53.8% against the 14.6% rise in CLSK shares.

Image Source: Zacks Investment Research

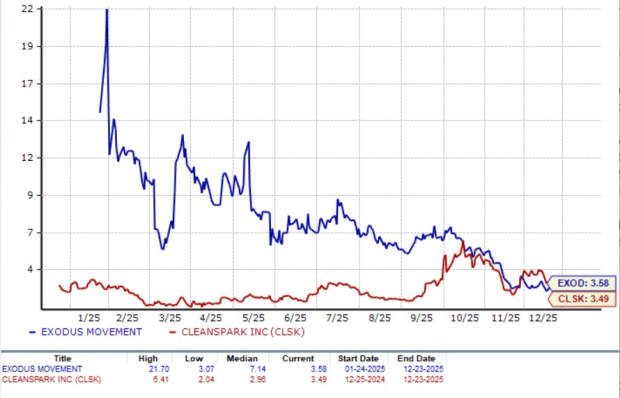

On the valuation front, EXOD trades at a forward 12-month P/S multiple of 3.58X, higher than CLSK’s 3.49X.

Image Source: Zacks Investment Research

Conclusion: EXOD vs. CLSK

EXOD is scaling a self-custodial wallet and Web3 platform while building stablecoin payments and B2B swap capabilities, while CLSK is pivoting from Bitcoin mining to AI and HPC infrastructure, bearing heavy competition and costs. Considering these factors, we can imply that EXOD is a better performer in the crypto market for the time being. EXOD carries a Zacks Rank #3 (Hold), while CLSK carries a Zacks Rank #4 (Sell) at present.