World Liberty Financial’s price has extended its rally that began in mid-December 2025, posting renewed gains over the past week.

The Trump family–associated token reacted sharply after former President Donald Trump launched an attack on Venezuela and captured Nicolás Maduro. The geopolitical development injected volatility, pushing WLFI to recent highs.

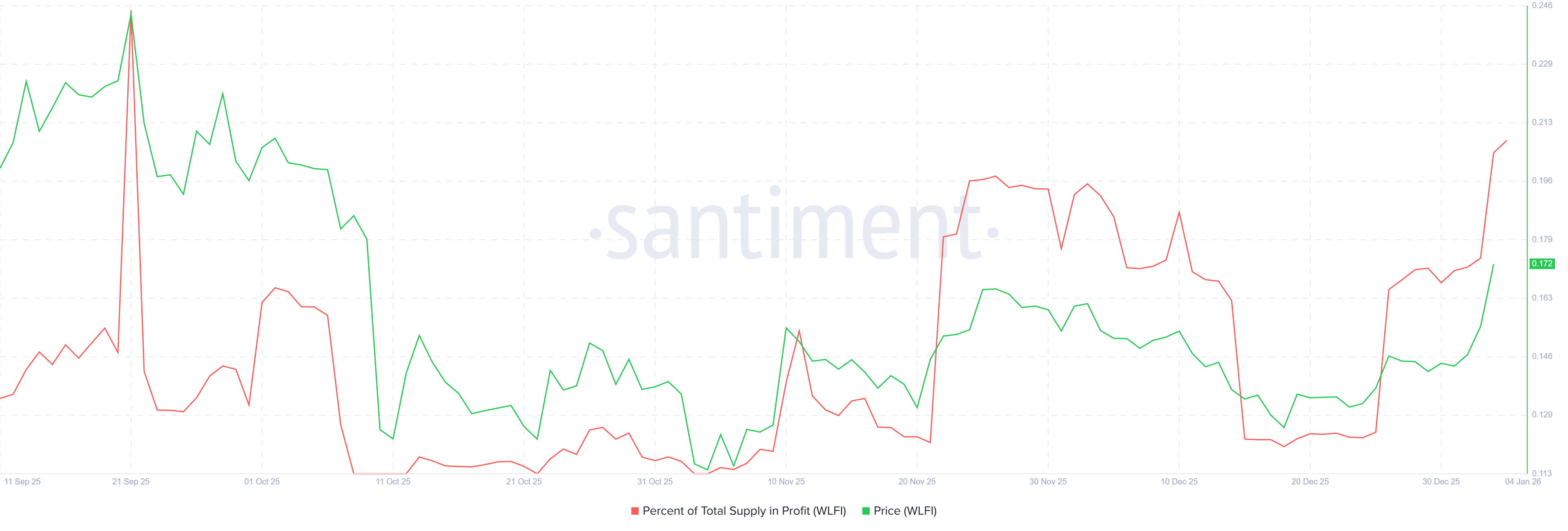

WLFI Holders Register Strong Profits

On-chain data shows a rapid improvement in holder profitability. WLFI profits jumped from roughly 25% to 40% within 24 hours following news of the US action.

As prices accelerated, the share of total supply in profit climbed to a four-month high, signaling a broad-based recovery across wallet cohorts.

This development benefits early participants who accumulated WLFI during its initial launch phase. Many of these investors endured the first major crash and are now seeing their positions return to profit.

Rising profitability often improves sentiment, though it can also incentivize selling as holders seek to lock in gains.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

WLFI Supply In Profit. Source: Santiment

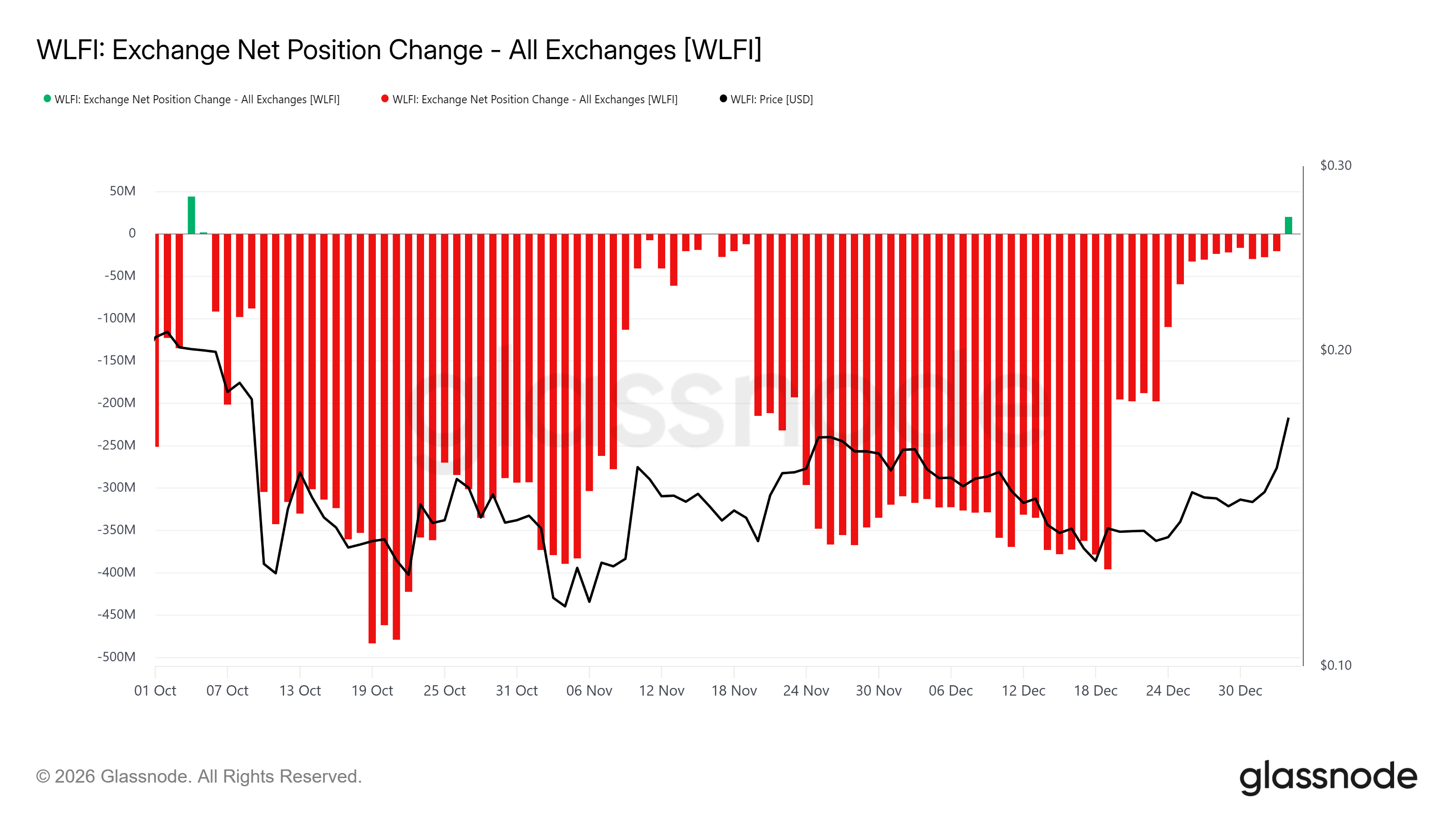

Despite improving profits, macro behavior suggests limited patience among WLFI holders. Exchange net position change data shows a green bar, the first recorded in nearly three months. This shift indicates net inflows of WLFI to exchanges, a common signal of distribution rather than accumulation.

Selling pressure tends to emerge quickly when profits expand after prolonged drawdowns. WLFI holders appear willing to exit at the first sign of recovery.

This behavior could cap further upside, as increased exchange balances raise available supply and absorb demand from new buyers.

WLFI Exchange Net Position Change. Source: Glassnode

WLFI Price Awaits Breakout From Pattern

WLFI trades near $0.172 at the time of writing after rebounding from $0.143 earlier this week. The token gained about 11% over the past 24 hours, reaching the upper boundary of an ascending broadening wedge. This structure reflects expanding volatility rather than directional certainty.

Although price sits near resistance, a breakout appears unlikely in the near term. Investors who returned to profit may continue selling, pressuring the price lower.

Under this scenario, WLFI could drift back toward the lower trend line, with $0.154 acting as the next key support.

WLFI Price Analysis. Source: TradingView

For a sustainable breakout to occur, WLFI would need to reclaim $0.172 as a firm support level. This would require reduced selling and renewed demand.

If bullish momentum persists and distribution remains limited, WLFI could push past resistance and advance toward $0.182, invalidating the bearish-neutral outlook.