Solana price prediction has turned bullish after Morgan Stanley filed for a Solana ETF, signaling rising institutional confidence in SOL. Along with SOL products, the bank filed with the SEC for regulatory approval to launch ETFs tied to Bitcoin and Ethereum.

As the regulatory framework around the crypto market improves and U.S. President Donald Trump shows support for digital assets, this has encouraged even big banks like Morgan Stanley to enter the scene. The filing shows that the bank wants to deepen its presence in the cryptocurrency space.

Meanwhile, the Solana price is currently holding the key support level with over 8% gains in the past seven days. It began Wednesday’s session at $141, but broader weakness led to a 2% decline to a session low of $138.2. However, the $135 support level remains intact and could serve as a demand zone.

Why is Morgan Stanley’s Solana ETF filing important for SOL?

Morgan Stanley, one of the top banks in the U.S. with $1.8 trillion in assets under management, is advancing its plans in the digital assets world. The move has driven bullish sentiment in Solana price prediction, as these Solana ETFs can attract significant institutional liquidity and lend greater credibility to the digital asset. The bank submitted registration paperwork to the SEC for exchange-traded funds tracking Bitcoin and Solana.

SHOCKER: Morgan Stanley just filed for a spot Bitcoin and Solana ETF. H/t @TheBlock__ pic.twitter.com/AmYLeDTJBy

— Eric Balchunas (@EricBalchunas) January 6, 2026

Following Morgan Stanley’s October move to allow clients access to crypto, this marks a major shift. These products will serve as passive investment vehicles that hold spot tokens and will be offered to Morgan Stanley’s 19 million wealth management clients.

Bryan Armour, ETF analyst at Morningstar, said, “It’s interesting to see Morgan Stanley move into a commoditized market, and I suspect that means they want to move clients that invest in Bitcoin into their ETFs, which could give them a fast start despite their late entrance.” He further added, “A bank entering the crypto ETF market adds legitimacy to it, and others could follow.”

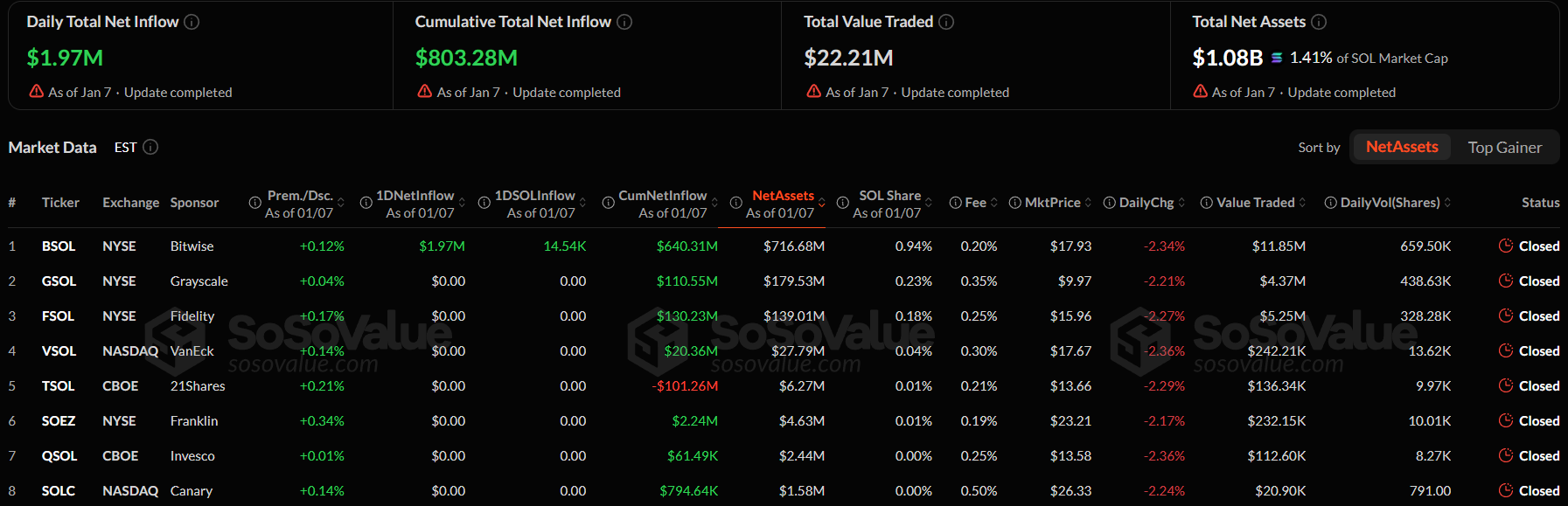

Solana ETFs are already performing well, even outperforming BTC and ETH funds during the recent market correction. Currently, spot SOL ETFs have recorded cumulative net inflows of $803.23 million and total net assets of $1.08 billion, representing 1.41% of Solana’s market cap. These inflows show growing institutional demand, strengthening the bullish narrative.

Source: sosovlaue

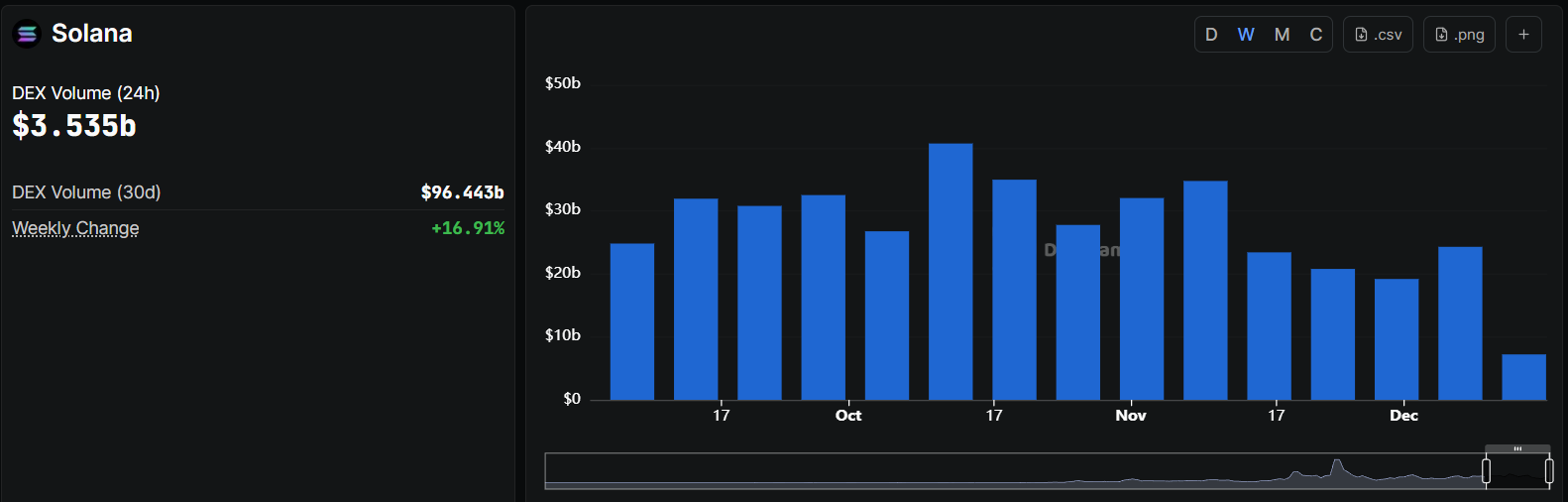

DEX Volume Surge Another Catalyst For SOL

The growing DEX volume in the Solana ecosystem has been another point of discussion when analyzing Solana price prediction. As meme coins take charge in the market reversal, altcoin DEX volumes have exploded by 39% over the past few weeks.

Source: DefiLlama

The massive volumes triggered after top Solana meme coins, like BONK, PENGU, and FARTCOIN, posted gains of over 40% during last week’s reversal rally. Increased demand for SOL as token fees and network adoption boost could act as a catalyst for the altcoin.

Will Solana Price Prediction Extend the Current Bullish Turnaround?

Despite strong catalysts in play, the broader crypto market has not been supportive of bulls over the past few months. After a strong reversal rally from the December low, Solana appears to be consolidating above its key moving-average support around $135. All short-term MAs, including 10-, 20-, and 50-day MAs, are in confluence, increasing their technical relevance.

The Relative Strength Index (RSI) on the daily chart has pulled back to 56 above the 14-day moving average and the midline, confirming a neutral zone following the reversal and slight sell-off.

Solana price chart. Image Courtesy: TradingView

On the weekly timeframe, for mid-term direction, Solana is trading inside a consolidation box with lower support at $120 and upper resistance at $145. A breakout in either direction could decide the altcoin’s momentum in the mid-term.

However, the short-term analysis shows strong bullish momentum for Solana. In a 4-hour timeframe, it has formed a bullish flag pattern with a breakout level at around $140. A breakout from the pattern could confirm a bullish continuation. However, if the price rejects and drops below $130, it would confirm that it’s just a downswing pullback, not a bull market.

With ETF momentum, rising on-chain activity, and strong technical support, Solana price remains cautiously bullish in the short to mid-term.