Bitcoin price prediction is once again the talk of the town after BTC slipped below $92,000 during Monday’s U.S. session, as global trade tensions accelerated, triggering long liquidations in the crypto market.

In the last six sessions, Bitcoin has printed consecutive red candles, dropping by over 6%. The drop came after U.S. President Donald Trump reignited trade tensions, threatening new tariffs on Denmark and other European countries amid his bid for Greenland. This move triggered a shift among investors toward traditional assets amid profit-taking in high-risk assets such as cryptocurrencies.

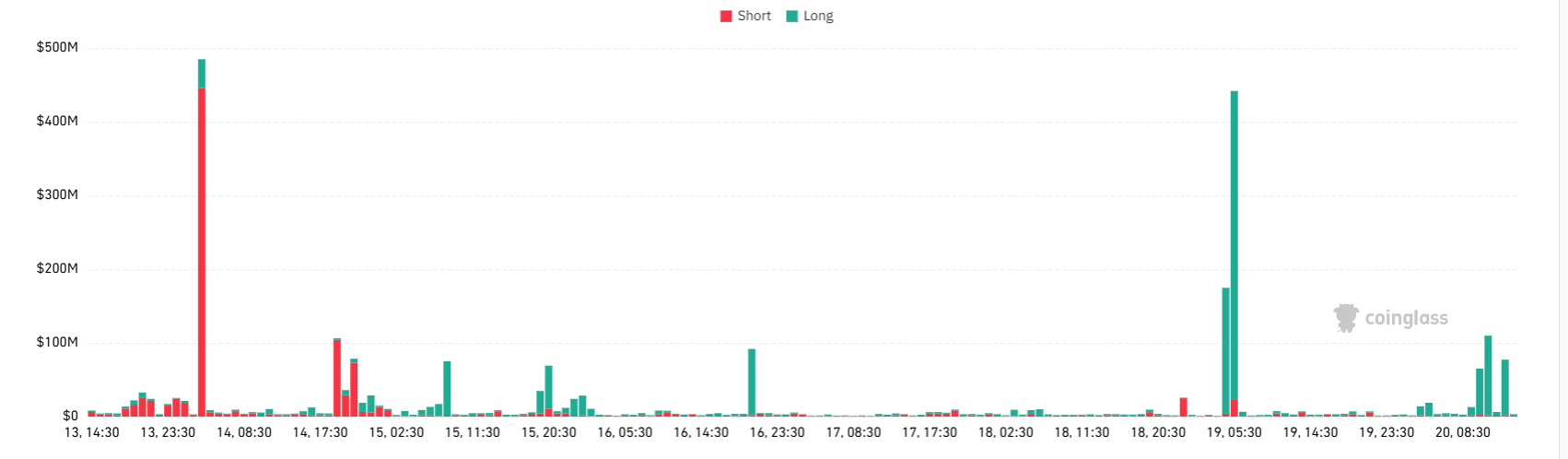

As bearish pressure intensified, BTC witnessed significant volatility, triggering liquidations worth over $865 million on Monday. Another mass liquidation was caused by Starknet-based DEX Paradex after a database migration error briefly priced bitcoin at $0.

Bitcoin’s price is still struggling to find support, with the RSI dipping below 50 and liquidations pushing it lower. Investors are now asking: Can it pull back after a steady downtrend?

Why Did Bitcoin Drop Below $92,000?

Despite a strong rebound to around $98,000 last week, Bitcoin dropped below $92,000 amid global trade uncertainties. The major reason for this decline was that President Donald Trump threatened to impose punitive tariffs on Greenland and other EU allies.

Global trade tensions negatively impact the crypto market by triggering a risk-off environment and a negative Bitcoin price prediction, prompting investors to reduce exposure to high-volatility assets like Bitcoin.

Source: CoinMarketCap

Farzam Ehsani, CEO of crypto trading platform VALR, said in a recent discussion, “Historically, tariff threats and retaliatory measures have created significant headwinds for digital and other risk assets. The market is now pricing in the possibility that prolonged escalations could disrupt previous trade agreements, strain international relations, and further pressure risk assets.”

This also raises concerns about slower global growth and tighter financial conditions. As uncertainty rises, leveraged positions in crypto markets become vulnerable, often resulting in long liquidations that accelerate downside moves.

Long Liquidations Intensify Bitcoin Volatility

Bitcoin saw a massive liquidation on Monday, with $865 million worth of excess leverage flushed from the system. Most of these liquidations were from bullish investors with and without leverage betting on last week’s surge.

Source: Coinglass

Since January 15, Bitcoin has lost $140 million in its market cap, currently at $1.81 trillion, while the total crypto market cap has dropped to around $3.2 trillion. These liquidations and bearish Bitcoin price prediction were mainly driven by crypto markets reacting to the return of the U.S.-EU trade tensions.

However, a technical error recently caused mass liquidation. A technical error at the Starknet-based decentralized exchange Paradex created a “free bitcoin” moment, prompting a planned blockchain rollback.

The exchange has not shared how many traders were affected or how much value was wiped out during liquidations. In a message to users, Paradex’s engineering head, Clement Ho, explained that the rollback would restore the platform to the most recent stable version before the glitch.

Bitcoin OG’s Selling After 12 Years Creates Headlines

In recent news, a dormant Bitcoin whale, inactive for around 12 years, has returned to the scene. The wallet dubbed “5K BTC OG” originally acquired BTC in 2012 for just $332 per coin. The whale has sold 2,500 BTC, offloading nearly half of its Bitcoin stash and securing a 31,250% profit.

An OG who received 5,000 $BTC 12 years ago sold another 500 $BTC($47.77M) today.

This OG originally received the 5,000 $BTC 12 years ago($1.66M at the time), when $BTC was priced at $332.

Since Dec 4, 2024, he has been selling $BTC, dumping 2,500 $BTC($265M) at an average price… pic.twitter.com/g9R3CuScFU

— Lookonchain (@lookonchain) January 18, 2026

The whale raked in around $265 million at an average exit price of $106,164. The broader market is currently under selling pressure, and Bitcoin’s price is struggling to hold key support levels amid selling from long-term investors, which could further depress the market in an already tense environment.

Bitcoin Price Prediction: Can BTC Recover After the Downtrend?

Bitcoin price traded at $90,878, down 1.96% over the past 24 hours. The largest crypto struggled to hold the $92,000 support earlier, but after briefly pushing through that level, it has dropped below $91,000.

The market is now testing whether the $90,000 psychological support level in Bitcoin will hold, after failing to break above $98,000. This support now coincides with the 50-day moving average, which served as strong support during the second week’s rebound.

Bitcoin price chart. Image courtesy: TradingView

Another factor to note in this decline is the missing volume, which indicates it is due to fewer buyers rather than more sellers. This indicates weakness in a trend, and if dip buyers step in, a sharp recovery could occur.

Current Bitcoin price action reflects a high volatility situation driven by various factors, including trade tensions and macroeconomic uncertainties. However, the bearish phase seems extended, and there could be a pullback on the long side. Market experts suggest potential for recovery once these headwinds clear.