The best altcoins to buy now before price rebound is always in investors mind although the fear and greed index stays at 10 on 10 February. While Bitcoin and Ethereum are still the most popular cryptocurrenceis, some altcoins are showing immense strength despite broader market weakness, including Solana (SOL), Pippin (PIPPIN) and XRP. Investors and firms are now closely watching ahead of a potential rebound.

Solana (SOL): Low Fees Strengthen Long-Term Appeal

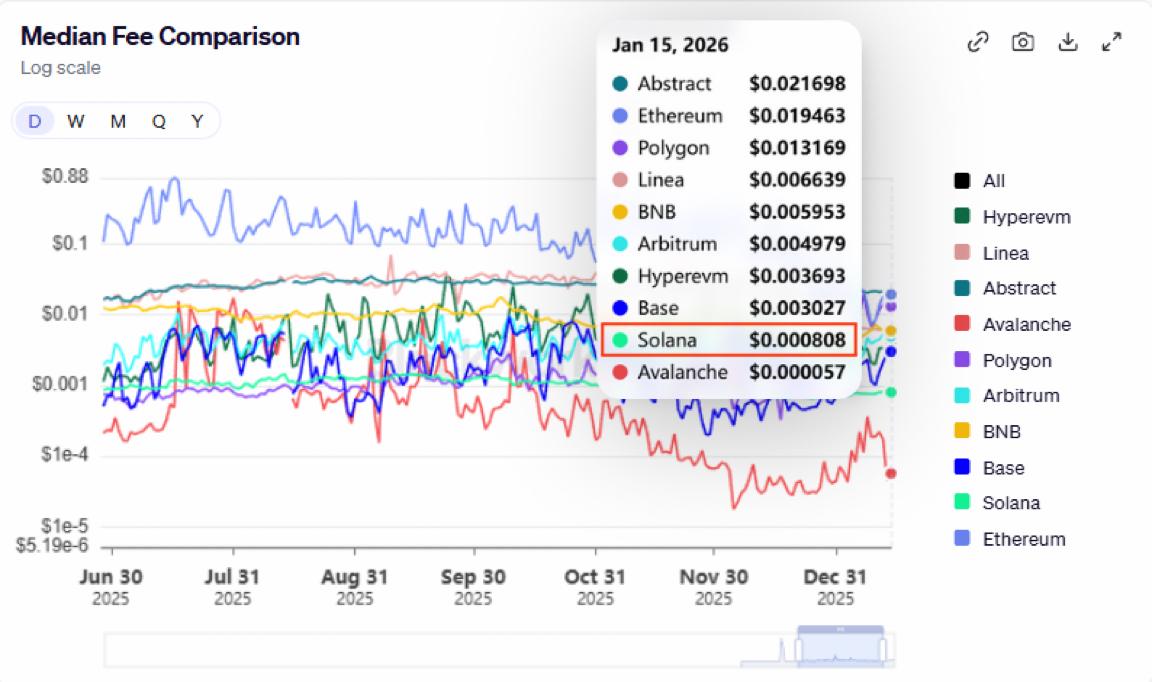

Solana continues to position itself as one of the most cost-efficient major blockchains, a key factor supporting its rebound potential. According to recent network data, Solana ranks among the second cheapest large-scale chains by median transaction fees, averaging roughly $0.0008 per transaction. This places it well below Ethereum and even several Ethereum Layer-2 networks, highlighting the advantages of Solana’s high-throughput, parallelized execution model.

Consistently low median fees indicate that everyday users and developers can transact without worrying about sudden cost spikes, even during periods of elevated activity. This predictability is particularly attractive for payments, gaming, and high-frequency on-chain trading. If usage continues to grow in Solana ecosystems, Solana’s structural cost advantage strengthens its investment case, positioning SOL as a leading candidate to benefit when broader market sentiment turns bullish again.

On ther other hand, Solana is also gaining support from major institutional investors. ARK Invest CEO Cathie Wood recently named SOL among a select group of cryptocurrencies that offer diversification benefits for modern portfolios. Wood noted that Solana’s price behavior differs from traditional risk assets, helping improve risk-adjusted returns. Backed by expanding institutional adoption and growing real-world blockchain use, Solana is increasingly viewed as a long-term cryptocurrency rather than a purely speculative trade.

Against consensus thinking these days, bitcoin, ether, Solana, and perhaps hyperliquid could be good diversifiers. Since early 2020, the correlation between the bitcoin price and the gold price has been very low, 0.14. Gold led bitcoin in the last two major bitcoin bull markets. https://t.co/7qQ1MAKuQW

— Cathie Wood (@CathieDWood) January 31, 2026

Pippin (PIPPIN): Technical Reversal and On-Chain Growth Align

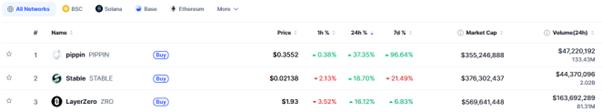

In early February, Pippin is emerging as one of the more compelling high-risk, high-reward altcoins. If you look the crypto market data, PIPPIN has often emerged as one of the top three strongest-performing coins when the crypto market rebounds.

Source: CoinMarketCap

The Solana-based AI memecoin is attempting a trend reversal after bouncing decisively from the $0.1565 demand zone. Price structure has improved, with higher lows forming and momentum indicators, such as the MACD histogram, signaling a bullish crossover.

Source: TradingView

PIPPIN is now trading near the $0.369 level after the volume expands. On-chain metrics reinforce this outlook. Glassnode data shows steady new address growth since November, even during recent corrections, pointing to sustained user interest. PIPPIN is one of the altcoins you should not overlook right now.

XRP: UAE Stablecoin Push Strengthens Rebound Narrative

XRP is regaining investor attention as Ripple deepens its footprint in the Middle East through an expanded partnership with UAE-based digital lender Zand Bank. The collaboration connects Zand’s dirham-backed stablecoin, AEDZ, with Ripple’s US dollar stablecoin, RLUSD, on the XRP Ledger, aiming to enable regulated institutions to operate within a compliant digital asset framework.

Zand and @Ripple, the leading provider of blockchain-based enterprise solutions across traditional and digital finance, are partnering to help advance and support the digital economy, with innovative solutions powered by the Zand AED (AEDZ) stablecoin and Ripple’s USD (RLUSD)… pic.twitter.com/8JXqjJgmTw

— Zand (@Official_Zand) February 10, 2026

The initiative focuses on custody, liquidity, and issuance mechanics under UAE supervisory standards, aligning with the country’s Digital Economy Strategy, which targets a significant expansion of the non-oil digital sector by 2032. Market projections suggest the global stablecoin market could reach $4 trillion, while RLUSD already holds a market capitalization of $1.5 billion.

Besides, Ripple’s new custody partnerships with Securosys and Figment enhance institutional-grade security on XRPL, driving XRP’s price higher in the future.