This fragmentation impacts everyone. Traders face worse pricing during volatility. Developers build applications that only access a fraction of available liquidity. Institutions struggle to deploy capital efficiently across ecosystems without relying on complex settlement processes.

As more chains, rollups, and execution environments come online, the problem scales. Liquidity depth grows, but coordination weakens. The market no longer needs more blockchains. It needs a way to unify what already exists.

That structural gap defines the opportunity LiquidChain targets.

How LiquidChain Fixes Fragmented Liquidity at the Execution Layer

LiquidChain is a Layer-3 execution and liquidity network that operates above Bitcoin, Ethereum, and Solana. Instead of competing with these ecosystems, it connects them through a unified settlement and execution layer.

The foundation of the system is unified liquidity pools. Assets originating from different blockchains are verifiably represented within LiquidChain, forming shared liquidity rather than isolated pools spread across bridges and wrappers. This allows capital to interact across ecosystems inside a single execution environment.

Execution runs through a high-performance virtual machine optimized for real-time DeFi activity. Multi-chain operations settle instantly, removing the latency penalties commonly associated with cross-chain transfers. For users and institutions, this improves price efficiency and execution reliability.

Security relies on trust-minimized cross-chain proofs and messaging. Bitcoin UTXOs, Ethereum accounts, and Solana states interact through verifiable mechanisms that enable atomic execution. This removes the need for centralized custodians and reduces the attack surface associated with traditional bridges.

LiquidChain functions as a global settlement layer. Developers deploy once and access liquidity across multiple ecosystems. Capital flows freely without being trapped inside individual chains. This design directly addresses the execution inefficiencies that grow as the market expands.

Crypto Presale Progress Signals Early Market Alignment

The LiquidChain crypto presale has already crossed over $500,000 raised, a notable milestone given broader market conditions. Early buyers show interest in execution-focused infrastructure rather than trend-driven narratives.

Presale buyers can stake their tokens immediately. More than 29 million $LIQUID tokens are already staked, which reduces the early circulating supply and aligns holders around long-term network usage. Early staking often correlates with confidence in roadmap delivery and execution viability.

Presale pricing remains at early-stage levels, providing defined entry conditions before full execution layers go live. As unified liquidity pools and settlement functionality activate, valuation frameworks typically adjust to reflect real usage potential.

Tokenomics That Support Long-Term Network Growth

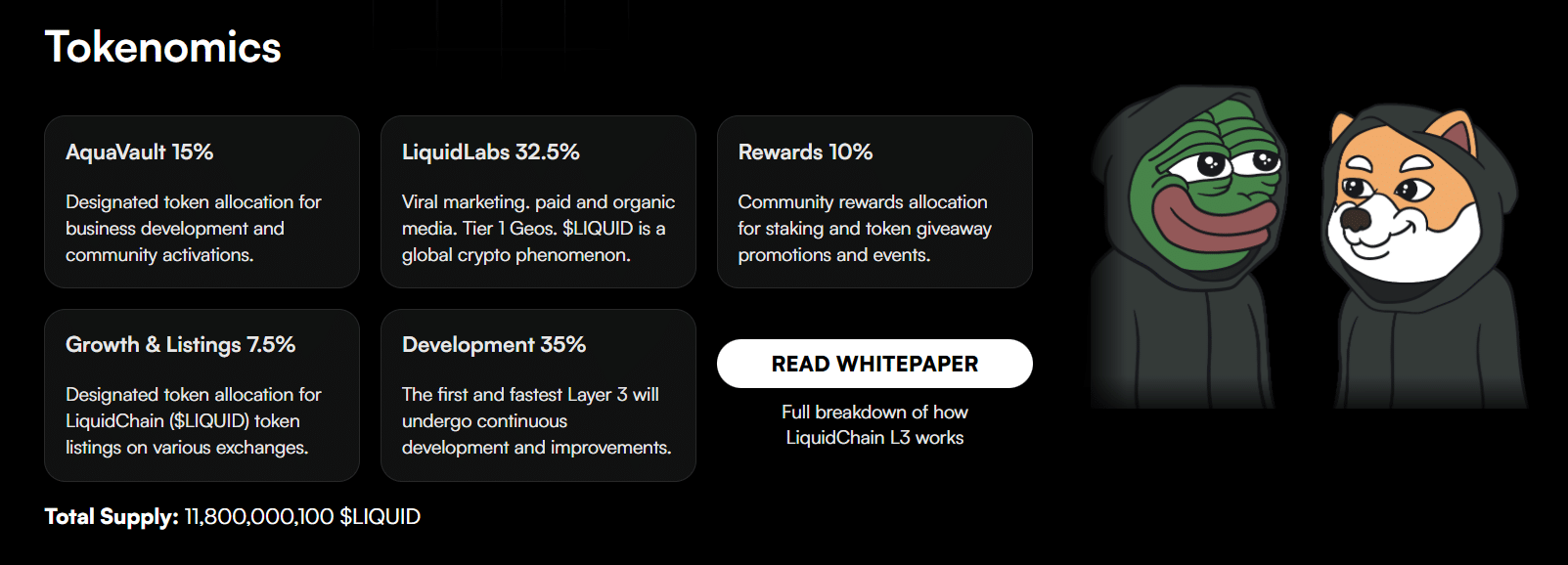

The $LIQUID token plays an active role in how the network operates. It is used for execution fees, liquidity routing incentives, staking, and participation across the protocol. Token demand grows with usage rather than speculative cycles.

Total supply is fixed at 11,800,000,100 $LIQUID, creating a defined scarcity framework. Allocation reflects infrastructure priorities. Development receives 35%, ensuring continuous improvements to the Layer-3 network. LiquidLabs holds 32.5% for ecosystem expansion, marketing, and global growth initiatives.

AquaVault accounts for 15%, supporting business development and community activations. Rewards make up 10%, funding staking programs and network participation incentives. The remaining 7.5% is allocated to growth and exchange listings.

Why $LIQUID Could Lead the Race

Overall, market cycles reward infrastructure when fragmentation becomes a constraint. Bitcoin and Ethereum liquidity continue to expand, yet coordination remains the missing piece. LiquidChain targets that gap directly.

Unlike isolated Layer-1s, LiquidChain enhances existing ecosystems instead of competing with them. Its role as a unifying execution layer reduces narrative risk and anchors value to functionality.

Among all altcoins heading into 2026, $LIQUID combines early positioning, fixed supply mechanics, and direct exposure to how capital moves across crypto. These traits often define trending cryptos worth researching before broader market recognition follows.

This crypto presale offers access to a new market layer built around execution and settlement rather than speculation. As liquidity fragmentation becomes impossible to ignore, LiquidChain’s role grows more central to the ecosystem.

That positioning places $LIQUID at the front of the infrastructure-driven altcoin cycle now taking place.