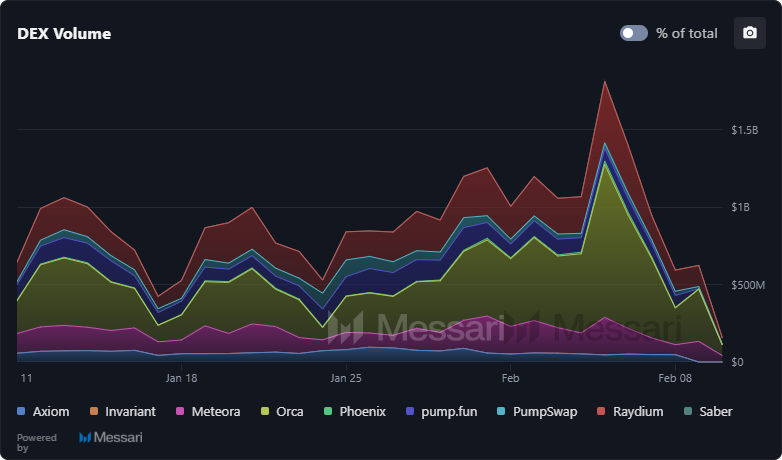

Solana (SOL) is currently trading near $85, struggling to find support after breaking below the critical $100 psychological level. According to data from CoinMarketCap, the asset has faced a 17.5% weekly decline. The sharp correction is being driven by a sudden collapse in Decentralized Exchange (DEX) trading volume, signaling a rapid evaporation of on-chain liquidity that previously fueled the asset’s rally.

Why DEX Volume Matters for Solana?

DEX volume serves as a vital proxy for network health and demand, particularly for high-throughput blockchains like Solana where DeFi activity is a primary value driver. During the market euphoria of January 2026, the network recorded a staggering monthly DEX volume of $117.7 billion, averaging nearly $3.8 billion in daily activity. This surge underpinned the aggressive price action seen earlier in the year.

Source: Messari

However, recent data indicates a severe retraction in speculative demand. As of February 9, daily DEX volume on the network plummeted to approximately $112 million—levels largely unseen since the early stages of the current cycle. When liquidity dries up, volatility often increases, aligning with institutional adjustments that have tempered near-term expectations for the asset while maintaining long-term targets.

Technical Structure Signals Continued Pressure

The technical outlook for Solana has deteriorated significantly following the loss of the triple-digit valuation. The $100 zone, which previously acted as critical support in the demand zone, has now flipped into heavy resistance. Attempted rallies into this region are likely to face selling pressure from trapped bulls looking to exit their positions.

Source: TradingView

Current chart structures suggest the price is trading within a broader bearish channel. After breaking down from the $120 region, SOL completed a near 40% drawdown. Analysts monitoring the formation note that if the temporary floor at $80 fails to hold, technical targets suggest a deeper correction toward the $75 or even $68 level could be imminent. Momentum indicators like the daily RSI is around 28, remaining in bearish territory and showing little sign of immediate reversal.

On-Chain Metrics Confirm Weakening Demand

On-chain data corroborates the bearish thesis presented by the price charts. The collapse in DEX volume to $112 million suggests that retail traders and market makers are stepping back, removing the liquidity cushion that absorbs sell pressure. This “liquidity freeze” makes the price more vulnerable to sharp downside swings on relatively lower volume.

According to Defi Scope, Solana spot ETFs recorded $2.82 million in inflows recently, this institutional interest has not been sufficient to counteract the drop in on-chain velocity. Total Value Locked (TVL) and fee generation metrics, which surged in early 2026, are now cooling off, indicating that the network’s user base is entering a period of consolidation or capitulation.

.@solana spot ETFs recorded net inflows of $2.82 million in February 2026 while Bitcoin funds saw outflows exceeding $434 million.

Institutional capital is separating short-term price weakness from sustained network utility as market volatility persists.

The network processed… pic.twitter.com/5p2tu9kkn0

— DeFi Scope (@DefiScope) February 9, 2026

What Could Invalidate the Bearish Setup?

Despite the prevailing downside risk, a durable recovery is not impossible. For bulls to regain control, Solana must reclaim the $100 level with significant volume, validating it as support rather than resistance. Furthermore, long-term conviction remains evident among prominent investors; for instance, Cathie Wood continues to list Solana as a top diversifier alongside Bitcoin and Ethereum, citing its structural throughput advantages.

A stabilization in the broader crypto market, particularly if Bitcoin finds a solid floor, could provide the necessary environment for Solana’s liquidity to return. Until then, traders should exercise caution near lower support bands.

Bitcoin Hyper: High-Beta Opportunities in a Volatile Market

As major altcoins like Solana face consolidation, high-risk, high-reward capital often rotates into emerging pre-market opportunities. Bitcoin Hyper is attracting attention from volatility traders looking for leveraged exposure to the Bitcoin ecosystem.

Positioned as a high-velocity Layer-2 solution, Bitcoin Hyper has raised significant capital in its ongoing presale, appealing to investors seeking early-entry advantages relative to established caps. With the market seeking new narratives beyond current L1 stagnation, BTH aims to capture liquidity searching for fresh momentum.

At the current rate of $0.013675 per $HYPER, the token offers promising opportunities in a volatile market.