AAVE fell 10% during the early hours of the Asian session on Monday, following a $50 million sell-off triggered by growing governance tensions.

The plunge comes amid allegations that Aave Labs, the company led by founder Stani Kulechov, redirected millions in swap fees from the DAO treasury without the approval of token holders, igniting debate over decentralized governance and founder control.

Revenue Dispute Sparks Community Outcry, AAVE Price Drops 10%

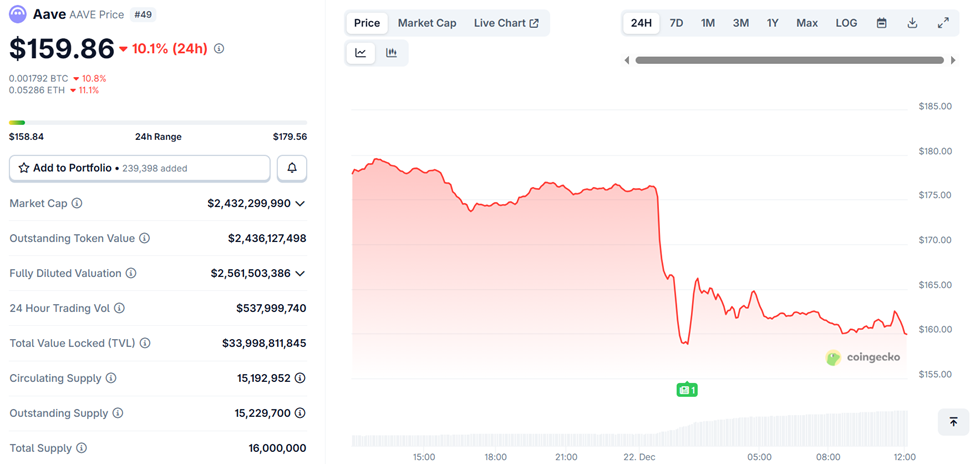

Amidst DAO governance drama and revenue controversy, the AAVE price has dropped by over 10% in the last 24 hours, trading at $159.86 as of this writing.

AAVE Price Performance. Source: BeInCrypto

AAVE Price Performance. Source: BeInCrypto

The controversy centers on Aave’s integration of CowSwap into its frontend, replacing ParaSwap. Critics claim that this shift, completed after Aave Labs received a grant from CowSwap, diverted up to $10 million in potential annual revenue away from the DAO.

An open letter from an Orbit delegate stated that the ParaSwap integration generated approximately $200,000 per week for the DAO.

DeFi community members argue that redirecting these fees undermines the DAO’s decentralized governance model.

Stani Kulechov and Aave Labs maintain that revenue from frontend operations is separate from core protocol revenue and has always been voluntary.

Nonetheless, questions remain over the CEO’s dual role and control of protocol assets, raising concerns about potential conflicts of interest.

DAO Alignment Proposal Moves to Snapshot

To address the crisis, Kulechov moved a controversial DAO alignment proposal to Snapshot for a formal vote.

The plan aims to transfer key brand assets, including domains and social media handles, from Aave Labs to the DAO.

“People are tired of this discussion, and getting into a vote is the best way to resolve. This is governance, end of the day,” Kulechov said, urging token holders to weigh in.

However, market confidence appears low. Polymarket odds indicate only a 25% chance of the proposal passing, a 26-point drop from earlier in the week.

Odds of Aave token alignment proposal passing. Source: Polymarket

Odds of Aave token alignment proposal passing. Source: Polymarket

Community members, such as Tulip King, have suggested that failing to pass the vote could push AAVE prices further down.

Market and Governance Implications

The episode highlights the broader challenges facing DAOs: aligning incentives among developers, service providers, and token holders while maintaining true decentralization.

Critics point to alternative models, such as Hyperliquid, where nearly all revenue is allocated toward token buybacks, and team compensation is paid in native tokens, as potential examples for Aave to follow.

“Maybe they need to look at Hyperliquid, where 99% of revenue goes to HYPE buy-backs. The team holds and is paid in HYPE. Everyone wins. Why can’t Aave Labs do the same? The pie is big enough already, or are DAOs inherently flawed?” posed analyst Duo Nine.

The Snapshot vote requires a quorum of 320,000 YAE votes and a margin of at least 80,000 votes over rival options to pass. Voting will remain open for three days, giving token holders time to consider the protocol’s next steps.

In the meantime, the AAVE sell-off highlights the market’s concerns about governance transparency and whether token holders can trust that protocol revenues serve the DAO rather than private interests.

As the community heads to the polls, the outcome could set a significant precedent for Aave and the broader DeFi ecosystem.