Zcash (ZEC) declined sharply in recent trading after a public governance dispute led the core development team to sever ties with the Electric Coin Company (ECC), one of the organizations historically responsible for building and maintaining the privacy-focused blockchain. The token fell roughly 13% after the announcement, reflecting investor uncertainty around organizational stability rather than any technical issue with the network itself.

? The entire staff of the developer behind Zcash, has resigned.

CEO Josh Swihart said the departures followed a governance dispute with the nonprofit Bootstrap board. He added that the Zcash protocol itself is not affected by the resignations.$ZEC is down 10% on the news pic.twitter.com/01Y8nbuRtP

— Satoshi Club (@esatoshiclub) January 8, 2026

The sell-off followed statements from ECC leadership confirming that the entire development staff had resigned and would form a new, independent company. While Zcash’s protocol continues to operate as normal, the abrupt organizational split introduced near-term uncertainty that weighed on market sentiment.

Governance Conflict Behind the Price Move

Josh Swihart, who became CEO of Electric Coin Company in late 2023, said the decision came after weeks of escalating conflict with the board of Bootstrap, the nonprofit entity that controls ECC. According to Swihart, recent changes to employment terms by a majority of the board made it impossible for the team to work independently while remaining aligned with Zcash’s mission.

Over the past few weeks, it's become clear that the majority of Bootstrap board members (a 501(c)(3) nonprofit created to support Zcash by governing the Electric Coin Company), specifically Zaki Manian, Christina Garman, Alan Fairless, and Michelle Lai (ZCAM), have moved into…

— Josh Swihart ? (@jswihart) January 7, 2026

Swihart described the situation as a “constructive discharge,” a legal concept used when working conditions are altered so significantly that employees are effectively forced to resign. On January 7, the entire ECC team stepped down simultaneously and announced plans to continue privacy-focused development through a new organization.

Board members named in Swihart’s public statements include Zaki Manian, Christina Garman, Alan Fairless, and Michelle Lai. No criminal allegations have been made by either side, and the dispute remains confined to governance and organizational control.

Market Reaction and Trading Activity

The governance fallout prompted a swift reaction across exchanges. As of writing, ZEC dropped approximately 13% in the last 24 hours. During the move, 24-hour trading volume rose more than 30% to roughly $800 million, signaling heightened short-term speculation and repositioning by traders.

Despite the price decline, there were no reports of protocol disruptions, security concerns, or privacy failures. Zcash’s codebase is open source and permissionless, meaning no single organization controls the network’s operation.

Background on Zcash’s Governance Structure

Zcash’s governance has long been complex. The protocol emerged from academic research into zero-knowledge cryptography, with ECC formed in 2015 to launch the network in 2016. The Zcash Foundation was later created to reduce centralization, and ECC became a nonprofit subsidiary of Bootstrap in 2020.

Image Courtesy: ECC

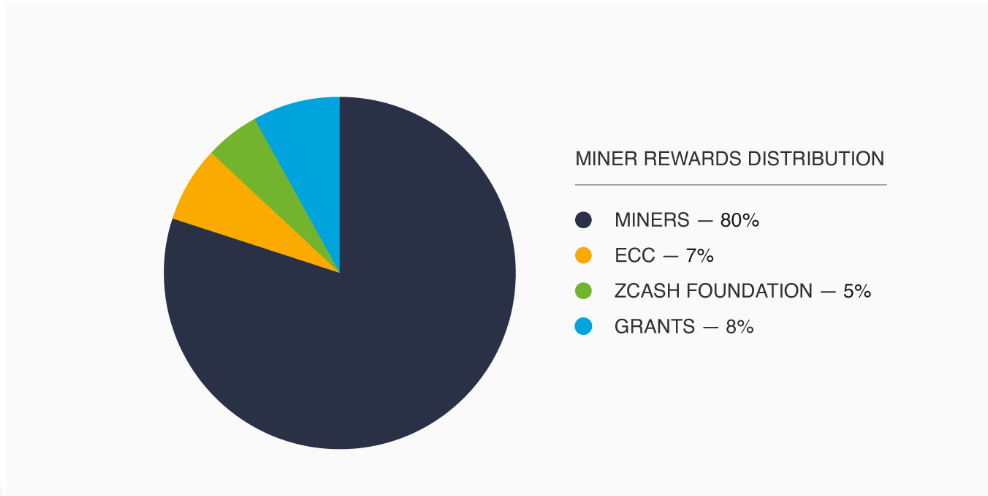

Tensions have intensified around the future of Zcash’s development fund, which allocates a portion of block rewards to protocol development and is scheduled to expire in late 2025. Swihart has previously advocated for shifting away from direct protocol funding toward grant-based models.

Zcash founder Zooko Wilcox has stated that the dispute does not affect network security or privacy guarantees, emphasizing that the disagreement is organizational rather than technical.

Big drama in one (or two now?) of the many Zcash support orgs. None of it involves me or Shielded Labs, and it's not my place to opine on it, except I want you to tell you two things: ⤵️ https://t.co/QJmH9vhbBS

— zooko???? ⓩ (@zooko) January 7, 2026

Broader Implications

Zcash’s price decline appears driven by governance uncertainty rather than fundamental changes to the protocol. How development responsibilities and funding are reorganized in the coming months may influence longer-term confidence, but for now, the network itself remains operational and unchanged.